Tax Brackets 2025 Single Head Of Household Spectacular Breathtaking Splendid. Single taxpayers who have dependents, though, should file as “ head of. We already covered the single filer.

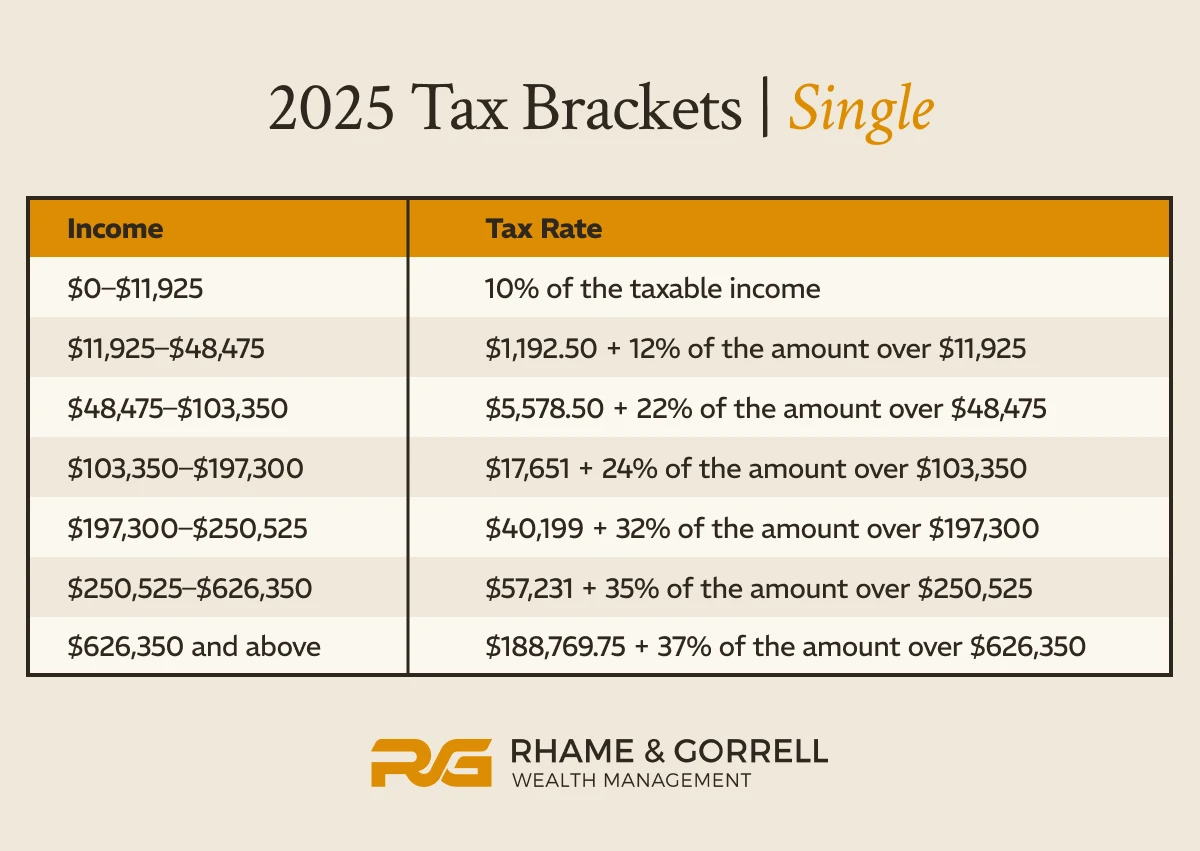

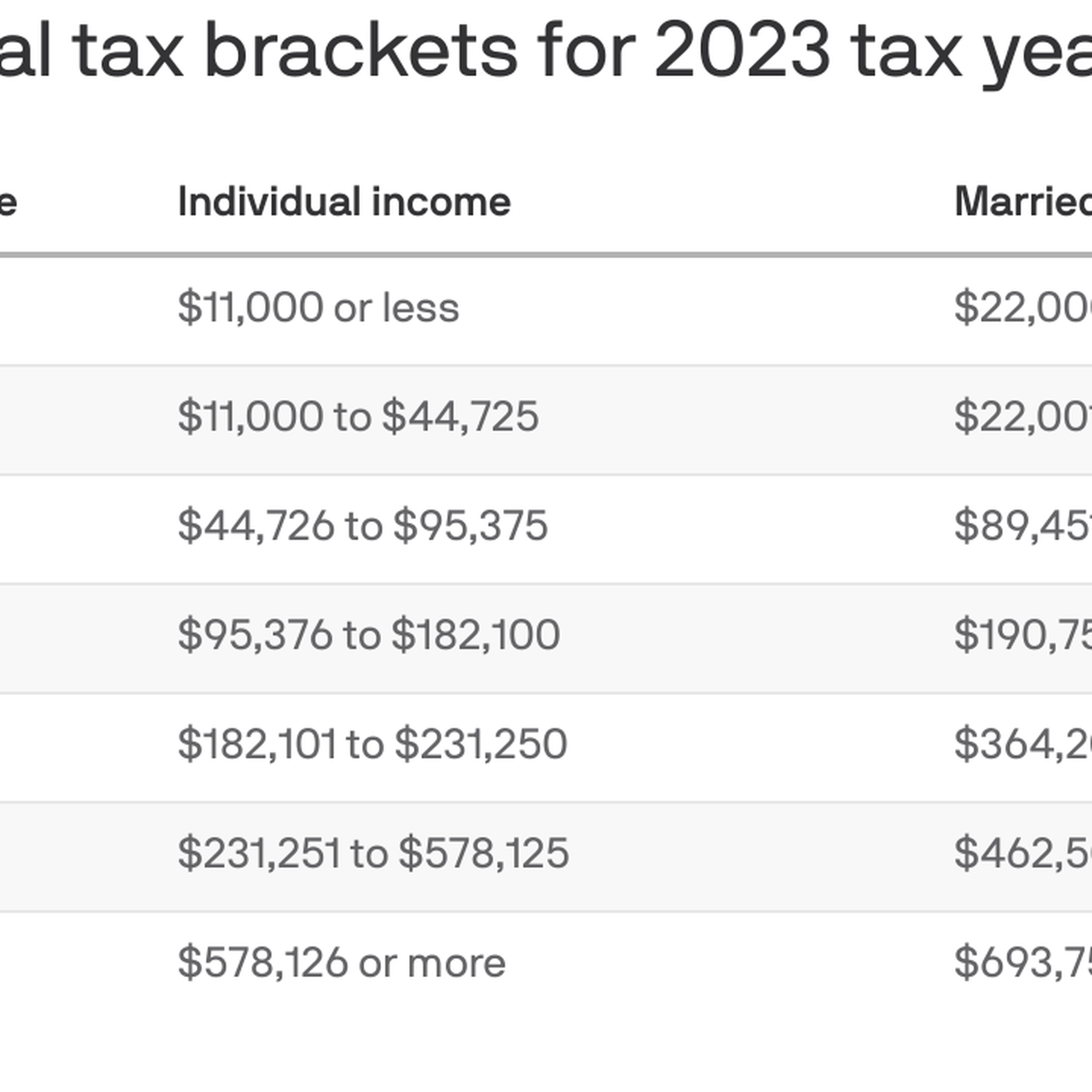

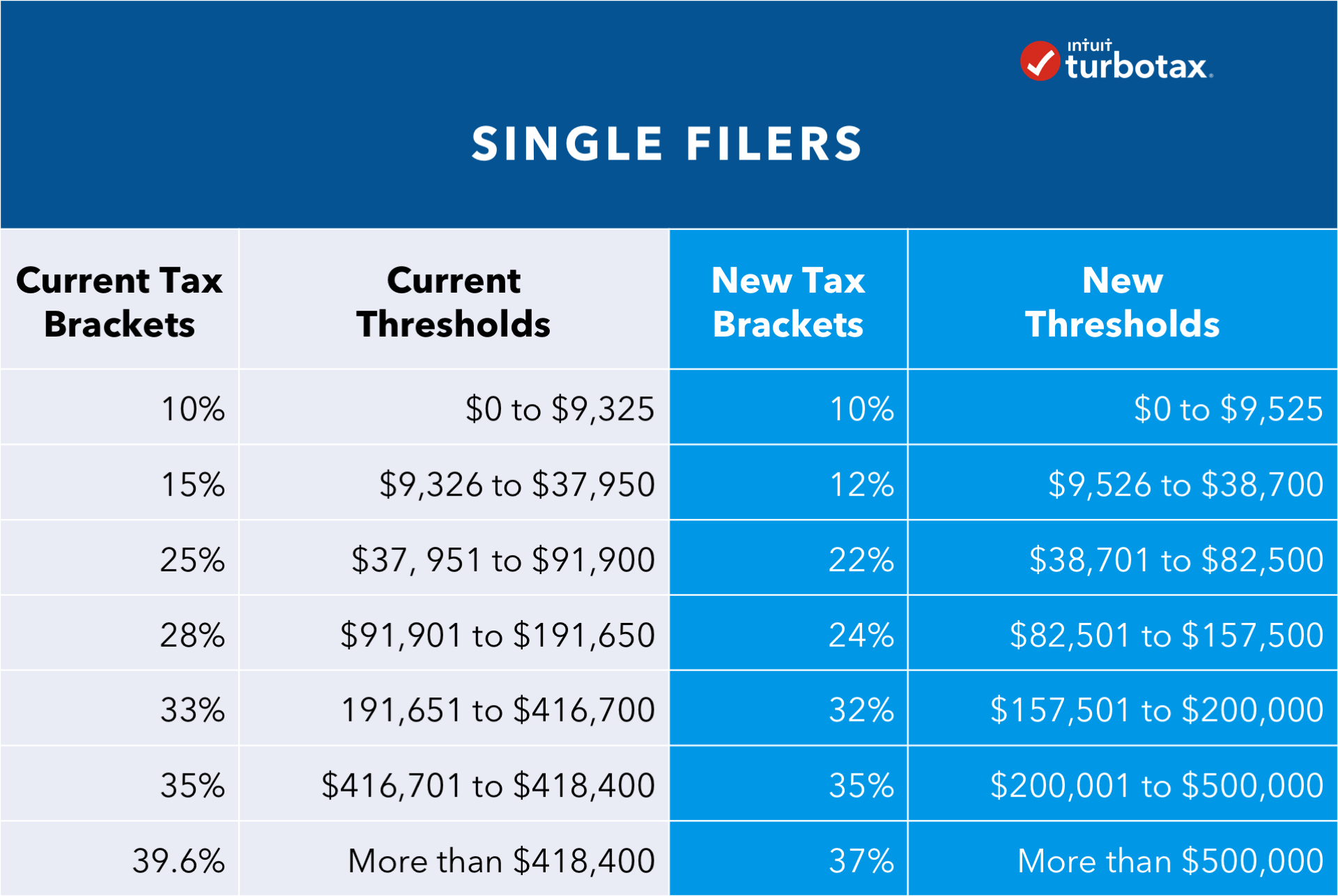

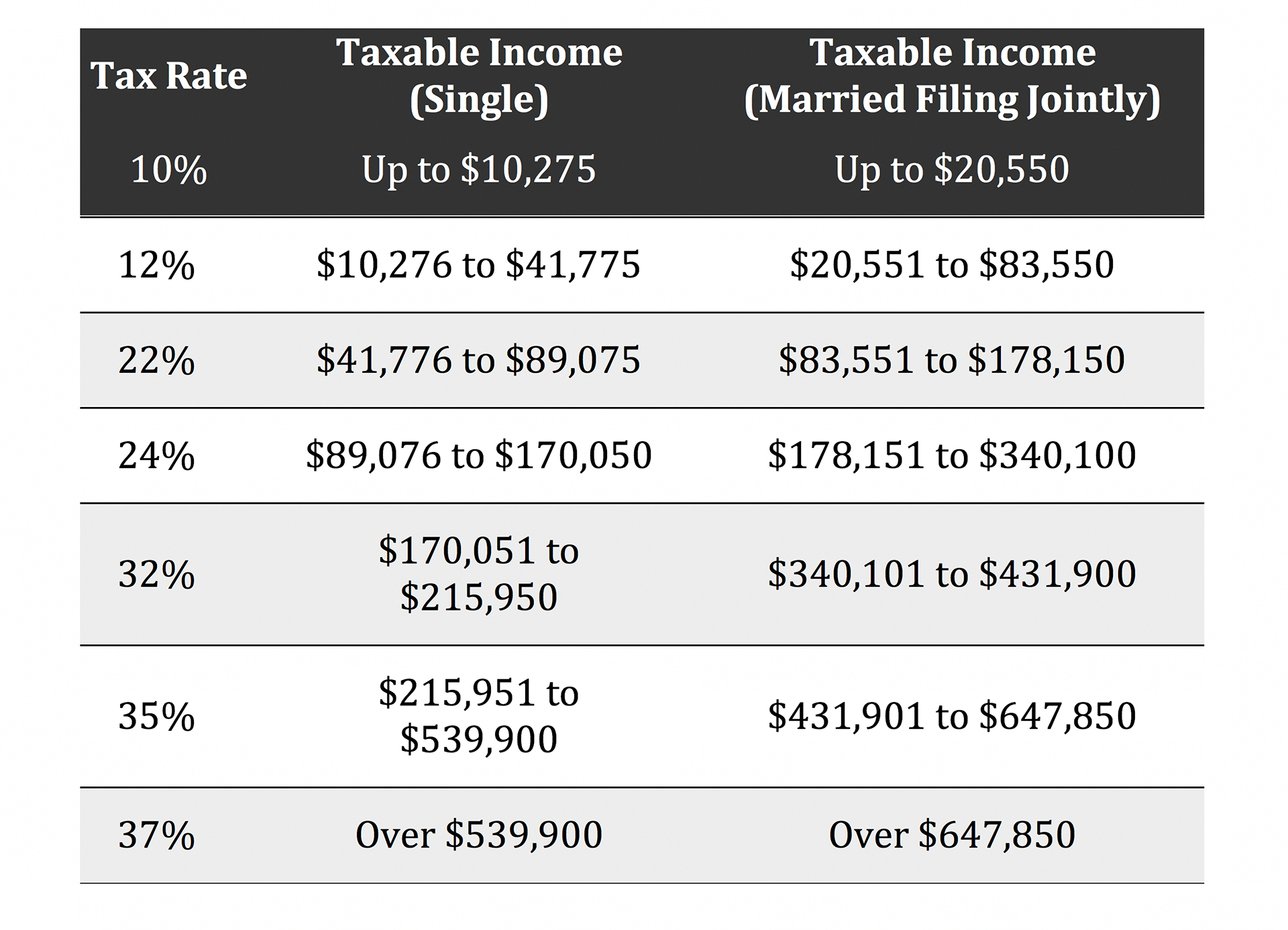

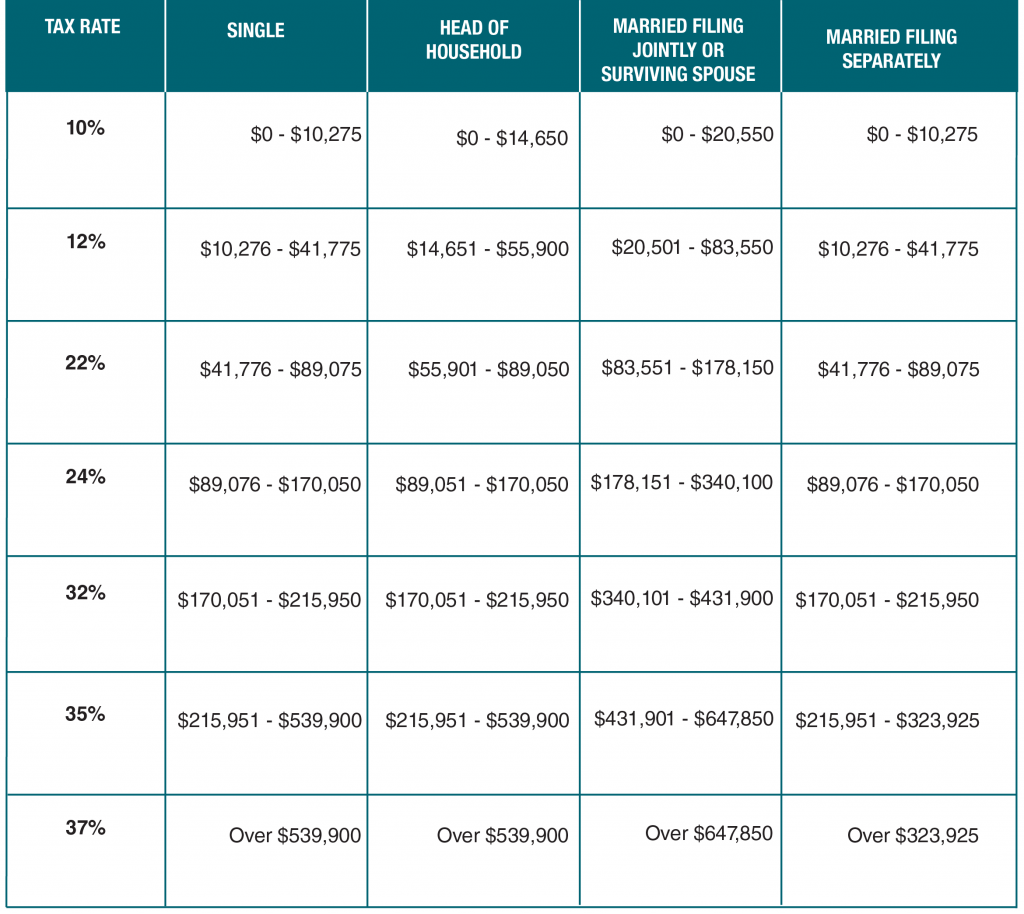

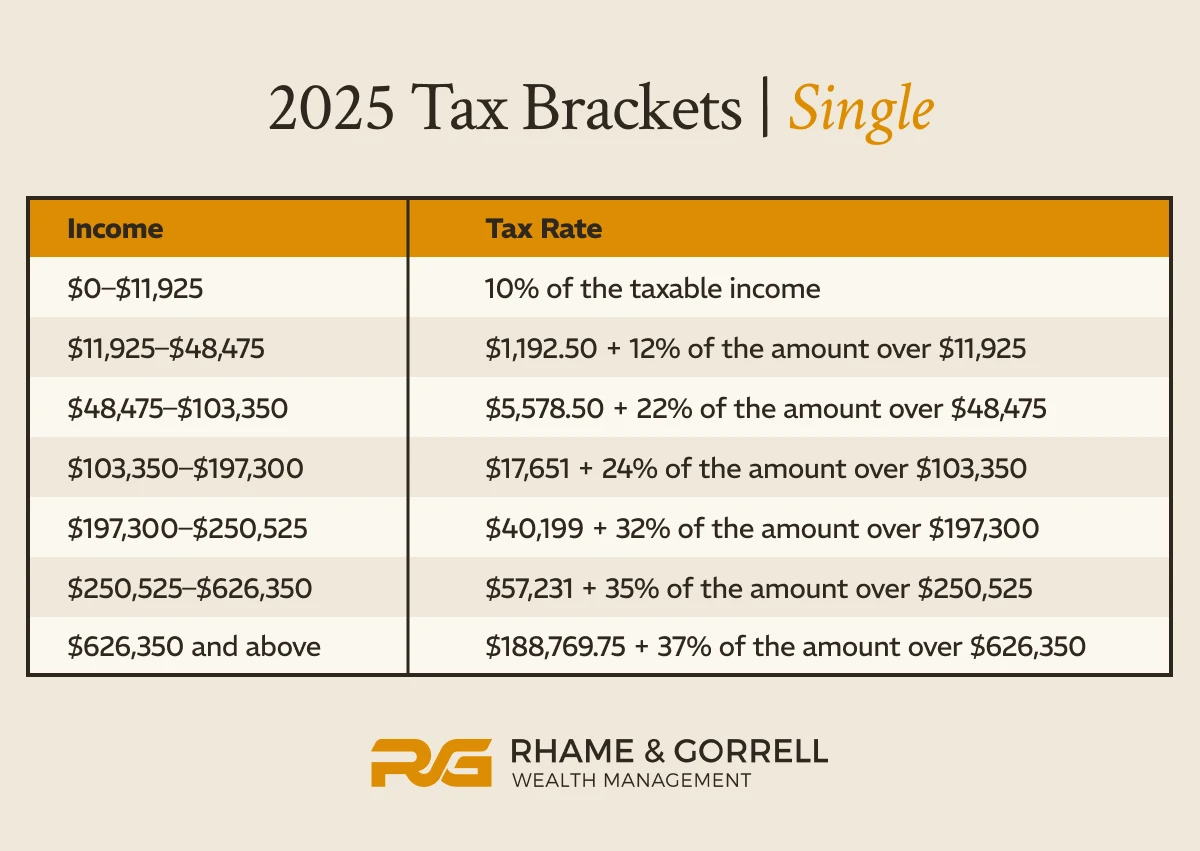

Find the 2025 tax rates (for money you earn in 2025). Here are the 2025 irs tax brackets for single filers and married couples filing jointly: For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an.

Source: ramifaith.pages.dev

Source: ramifaith.pages.dev

2025 Tax Brackets Head Of Household Rami Faith Only single people should use the single filing status. Find the 2025 tax rates (for money you earn in 2025).

Source: antonioporter.pages.dev

Source: antonioporter.pages.dev

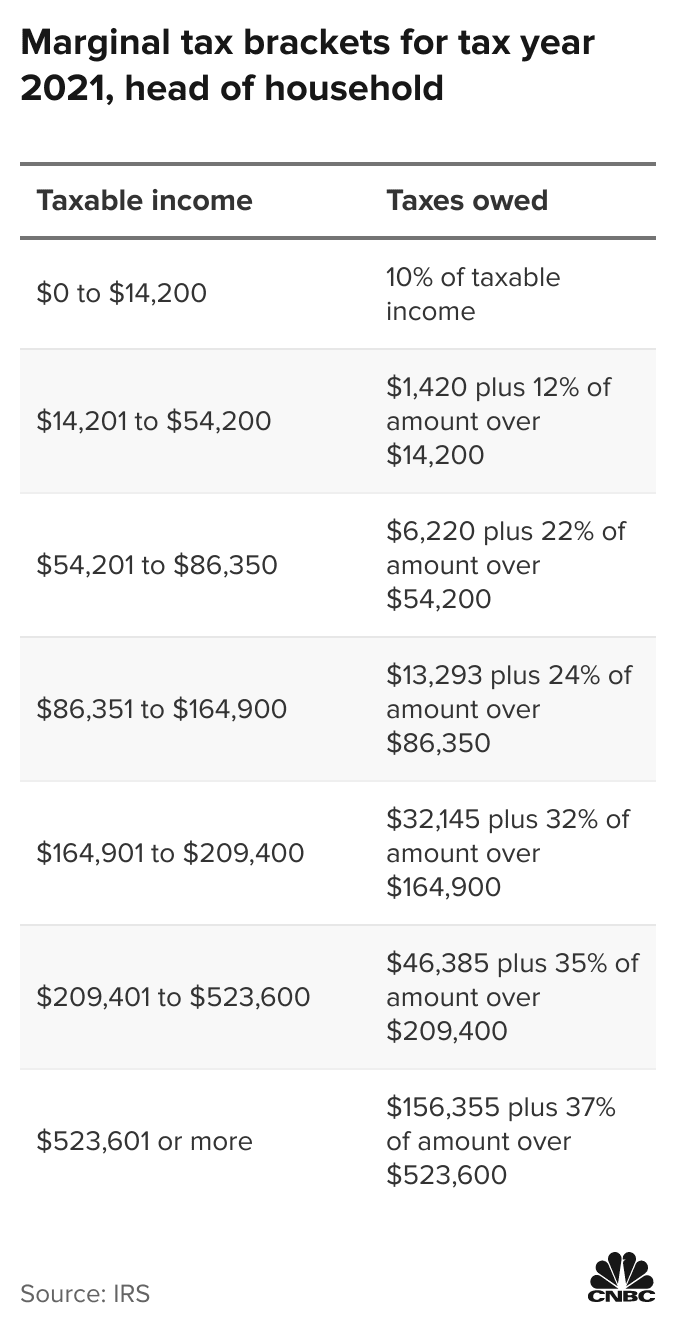

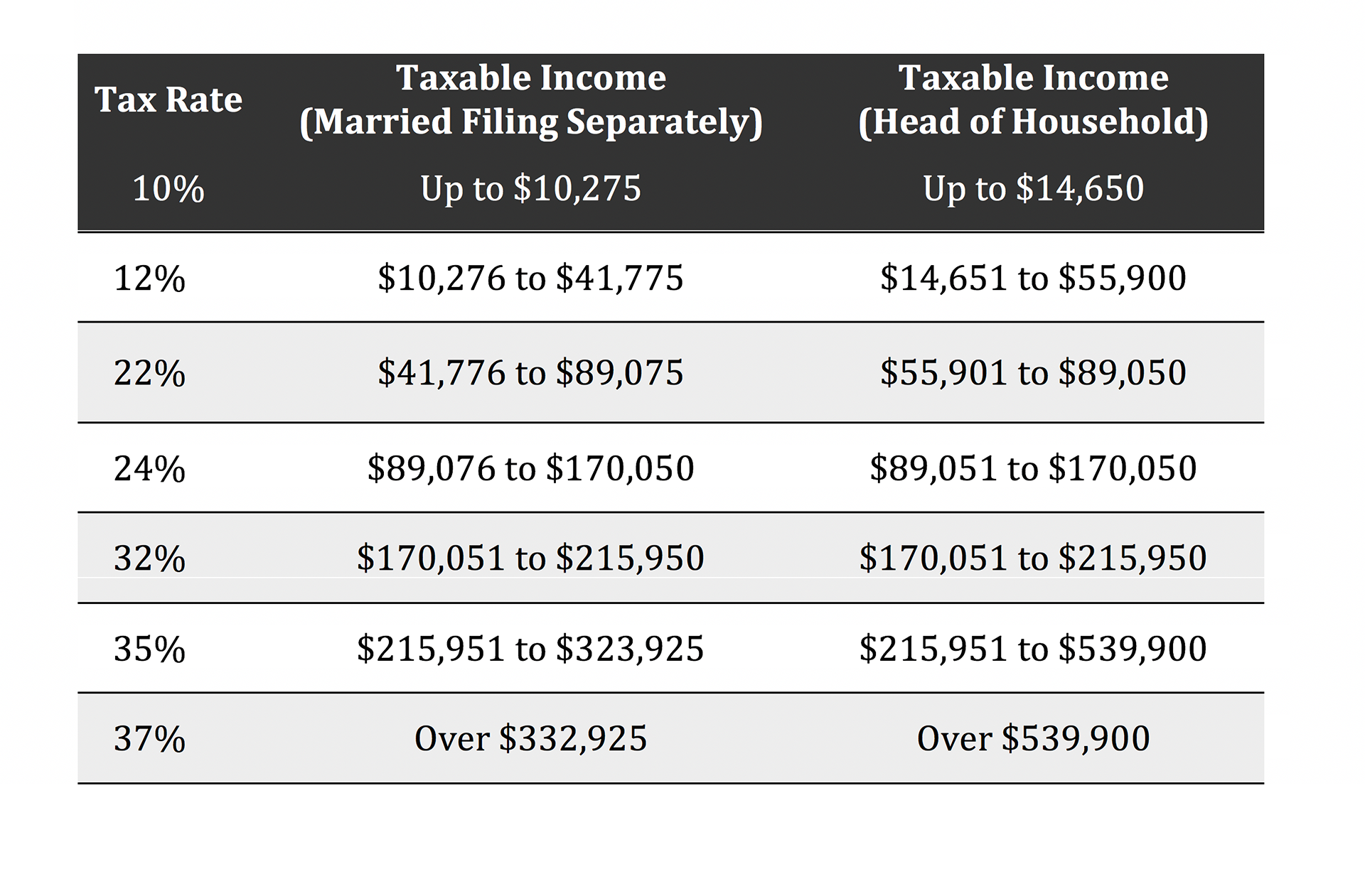

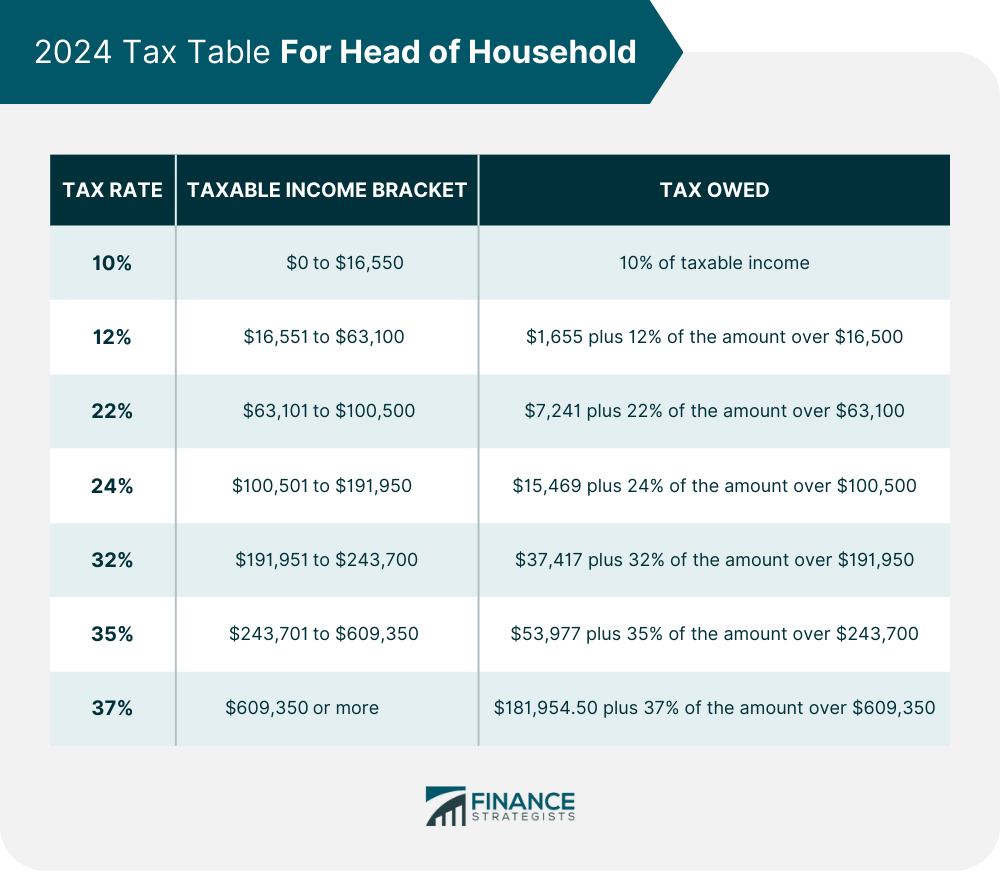

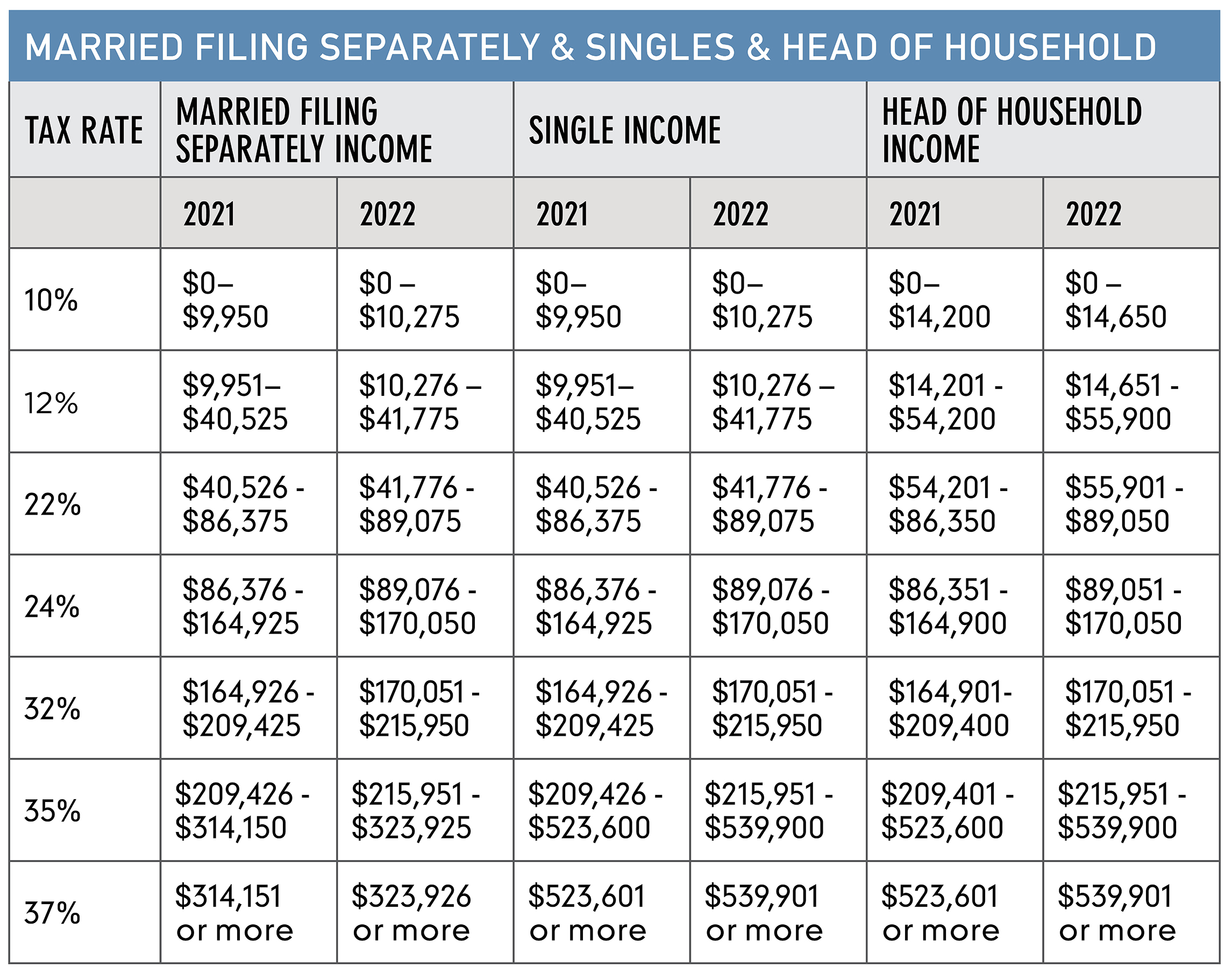

2025 Tax Brackets Single Head Of Household Antonio Porter Here are the 2025 irs tax brackets for head of household filers and married couples filing separately: Single taxpayers who have dependents, though, should file as “ head of.

Source: jamesprenfro.pages.dev

Source: jamesprenfro.pages.dev

Head Of Household Tax Brackets 2025 James P. Renfro Federal tax rates and brackets for 2025 the tax rates remain unchanged, but income thresholds have been adjusted for inflation to prevent “bracket creep.” here’s how they break down for different filing statuses: Only single people should use the single filing status.

Source: poppyhaleyp.pages.dev

Source: poppyhaleyp.pages.dev

Tax Brackets 2025 Single Head Of Household Poppy P. Haley Here are the 2025 irs tax brackets for head of household filers and married couples filing separately: Find the 2025 tax rates (for money you earn in 2025).

Source: georgebuttersm.pages.dev

Source: georgebuttersm.pages.dev

Tax Brackets 2025 Irs Single M. Butters Here are the 2025 federal tax brackets: Only single people should use the single filing status.

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville Single taxpayers who have dependents, though, should file as “ head of. We already covered the single filer.

Source: adelinemae.pages.dev

Source: adelinemae.pages.dev

2025 Tax Brackets Head Of Household 2025 Adeline Mae Federal tax rates and brackets for 2025 the tax rates remain unchanged, but income thresholds have been adjusted for inflation to prevent “bracket creep.” here’s how they break down for different filing statuses: See current federal tax brackets and rates based on your income and filing status.

Source: alicalynasl.pages.dev

Source: alicalynasl.pages.dev

2025 Tax Brackets Married Filing Separately Calculator Alica L. Lynas 12% on income from $11,926 to. Here are the 2025 federal tax brackets:

Source: poppyhaleyp.pages.dev

Source: poppyhaleyp.pages.dev

Tax Brackets 2025 Single Head Of Household Poppy P. Haley We already covered the single filer. See current federal tax brackets and rates based on your income and filing status.

Source: utammueller.pages.dev

Source: utammueller.pages.dev

2025 Tax Brackets Head Of Household Married Filing Jointly Uta M. Mueller Discover the 2025 tax brackets, federal income tax rates, and how marginal tax rates impact your earnings. Only single people should use the single filing status.

Source: jamiezburns.pages.dev

Source: jamiezburns.pages.dev

2025 Personal Deduction Head Of Household Jamie Z Burns Here are the 2025 irs tax brackets for single filers and married couples filing jointly: Federal tax rates and brackets for 2025 the tax rates remain unchanged, but income thresholds have been adjusted for inflation to prevent “bracket creep.” here’s how they break down for different filing statuses:

Source: jeaneasefeodora.pages.dev

Source: jeaneasefeodora.pages.dev

Tax Brackets 2025 Head Of Household Tish AnneCorinne For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an. 10% on income up to $11,925 ;