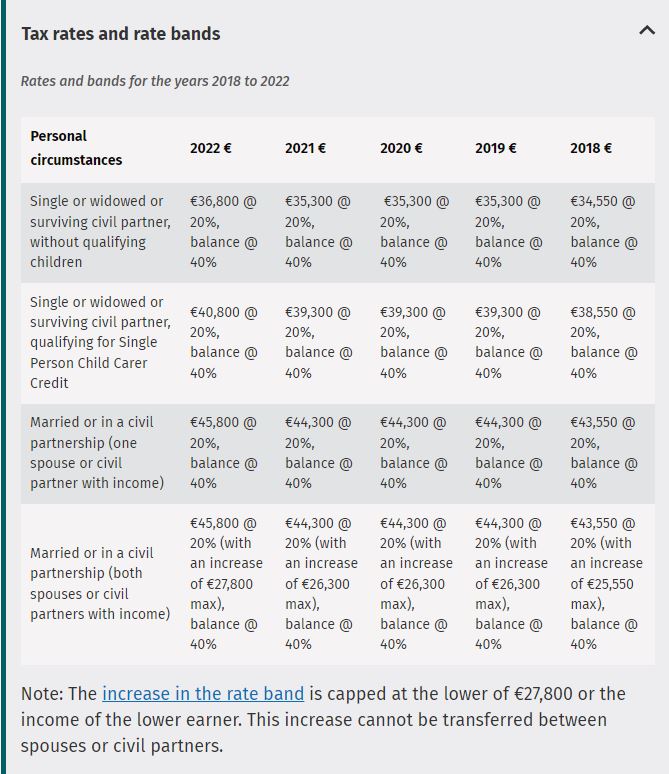

Tax Brackets 2025 Ireland Finest Ultimate Prime. These limits are increased in respect of dependent children. The 4% rate of usc will be reduced for the second consecutive year to.

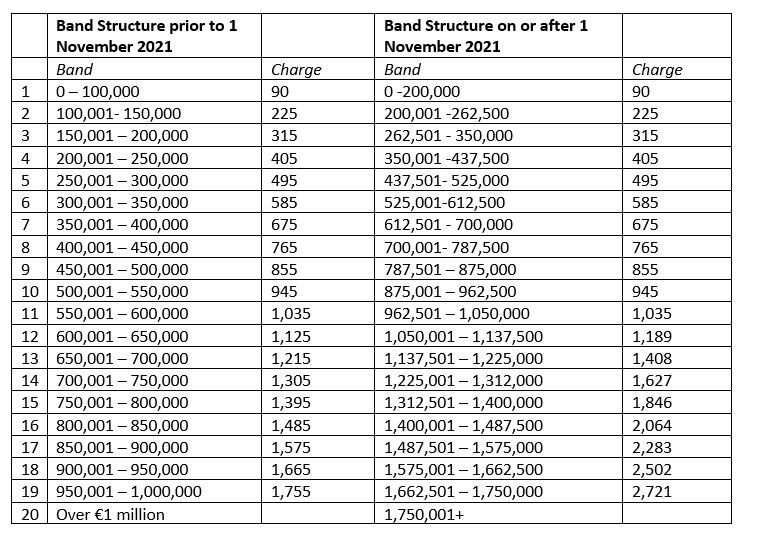

Find out the tax rates, rate bands and tax reliefs for the tax year 2025 and the previous four years in ireland. The 4% rate of usc will be reduced for the second consecutive year to. The standard [20%] rate band for income tax is to be increased by €2,000 to an amount of €44,000 per individual.

Source: rosaliewsanyork.pages.dev

Source: rosaliewsanyork.pages.dev

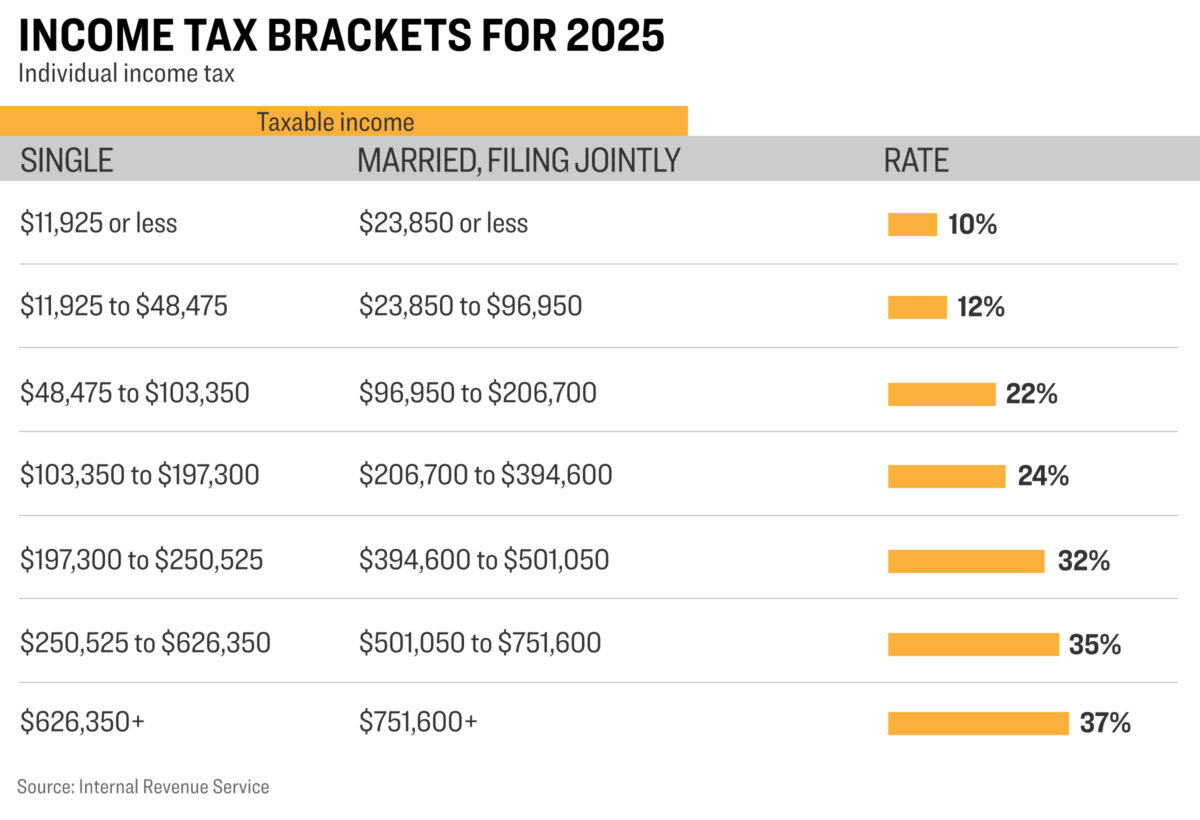

2025 Tax Brackets Vs 2025 Taxes Rosalie Sanyork Find the income tax rates, personal allowances, social security rates, vat rates, corporation tax rates and capital gains tax rates for ireland in 2025. For 2025, the specified limit is eur 18,000 for an individual who is single/widowed and eur 36,000 for a married couple.

Source: quinlanyorks.pages.dev

Source: quinlanyorks.pages.dev

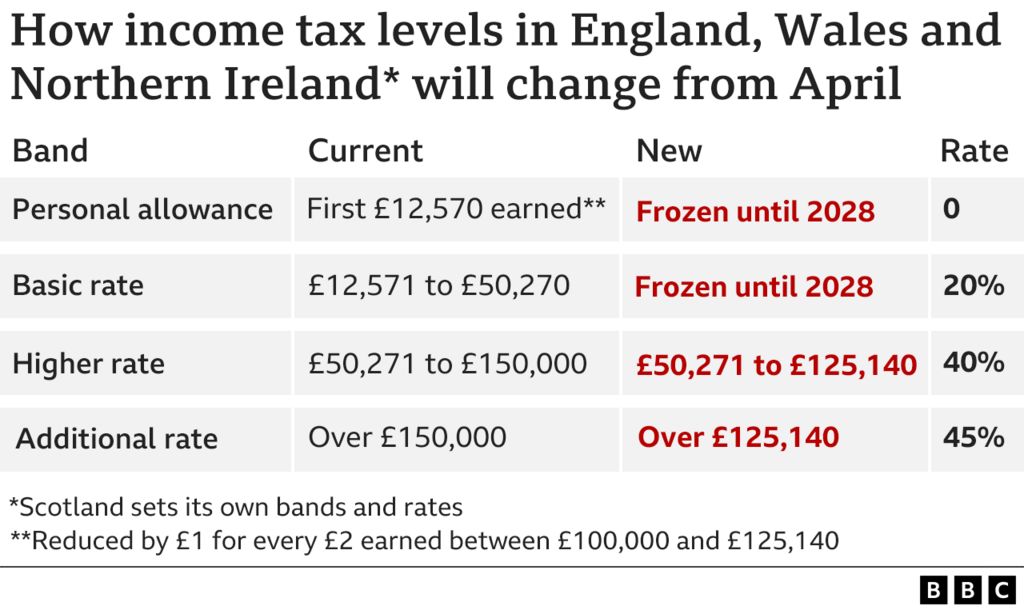

Tax Brackets 2025 Northern Ireland Images References Quinlan Yorks See how the usc rates. Find out the latest changes to personal and corporate tax rates, credits, reliefs and exemptions in ireland for 2025.

Source: johnataylor.pages.dev

Source: johnataylor.pages.dev

2025 Tax Brackets Ireland John A Taylor See how the usc rates. The standard [20%] rate band for income tax is to be increased by €2,000 to an amount of €44,000 per individual.

Source: rosiegeorge.pages.dev

Source: rosiegeorge.pages.dev

2025 Tax Brackets Ireland Rosie Compare the tax tables for. Compare the tables for different.

Source: chesterhall.pages.dev

Source: chesterhall.pages.dev

Tax Calculator 2025 Ireland Chester Hall Find out how your income tax is calculated based on your income, tax credits and tax allowances. Find out the tax rates, rate bands and tax reliefs for the tax year 2025 and the previous four years in ireland.

Source: karlnichols.pages.dev

Source: karlnichols.pages.dev

Tax Brackets 2025 Ireland Karl Nichols Compare the tables for different. Find out the latest changes to personal and corporate tax rates, credits, reliefs and exemptions in ireland for 2025.

Source: cecilielassenm.pages.dev

Source: cecilielassenm.pages.dev

New Tax Brackets 2025 Ireland Changes Cecilie M. Lassen See how the usc rates. Find out the latest changes to personal and corporate tax rates, credits, reliefs and exemptions in ireland for 2025.

Source: athenafthjenifer.pages.dev

Source: athenafthjenifer.pages.dev

New Tax Brackets 2025 Ireland Changes Alika Alexine Compare the tax tables for. Find out the latest changes to personal and corporate tax rates, credits, reliefs and exemptions in ireland for 2025.

Source: johnataylor.pages.dev

Source: johnataylor.pages.dev

2025 Tax Brackets Ireland John A Taylor Compare the tables for different. For 2025, the specified limit is eur 18,000 for an individual who is single/widowed and eur 36,000 for a married couple.

Source: braydenodonnellm.pages.dev

Source: braydenodonnellm.pages.dev

2025 Tax Calculator Ireland Brayden ODonnell Find out how your income tax is calculated based on your income, tax credits and tax allowances. Compare the tax tables for.

Source: chesterhall.pages.dev

Source: chesterhall.pages.dev

Tax Calculator 2025 Ireland Chester Hall For 2025, the specified limit is eur 18,000 for an individual who is single/widowed and eur 36,000 for a married couple. The standard [20%] rate band for income tax is to be increased by €2,000 to an amount of €44,000 per individual.

Source: paigeaoconnor.pages.dev

Source: paigeaoconnor.pages.dev

IRS 2025 Tax Rates A Comprehensive Guide To Projected Tax Brackets And Compare the tables for different. Find out how your income tax is calculated based on your income, tax credits and tax allowances.